Very intuitive and exceptional service. A refreshing change within the banking industry. Many other banks could learn from this.

Thomas, Trustpilot, July 31 2023**

I had an incredible experience talking to Alma from Lunar. Perfect service – I got approved very fast. Thank you!

Olga, Trustpilot, September 7 2023**

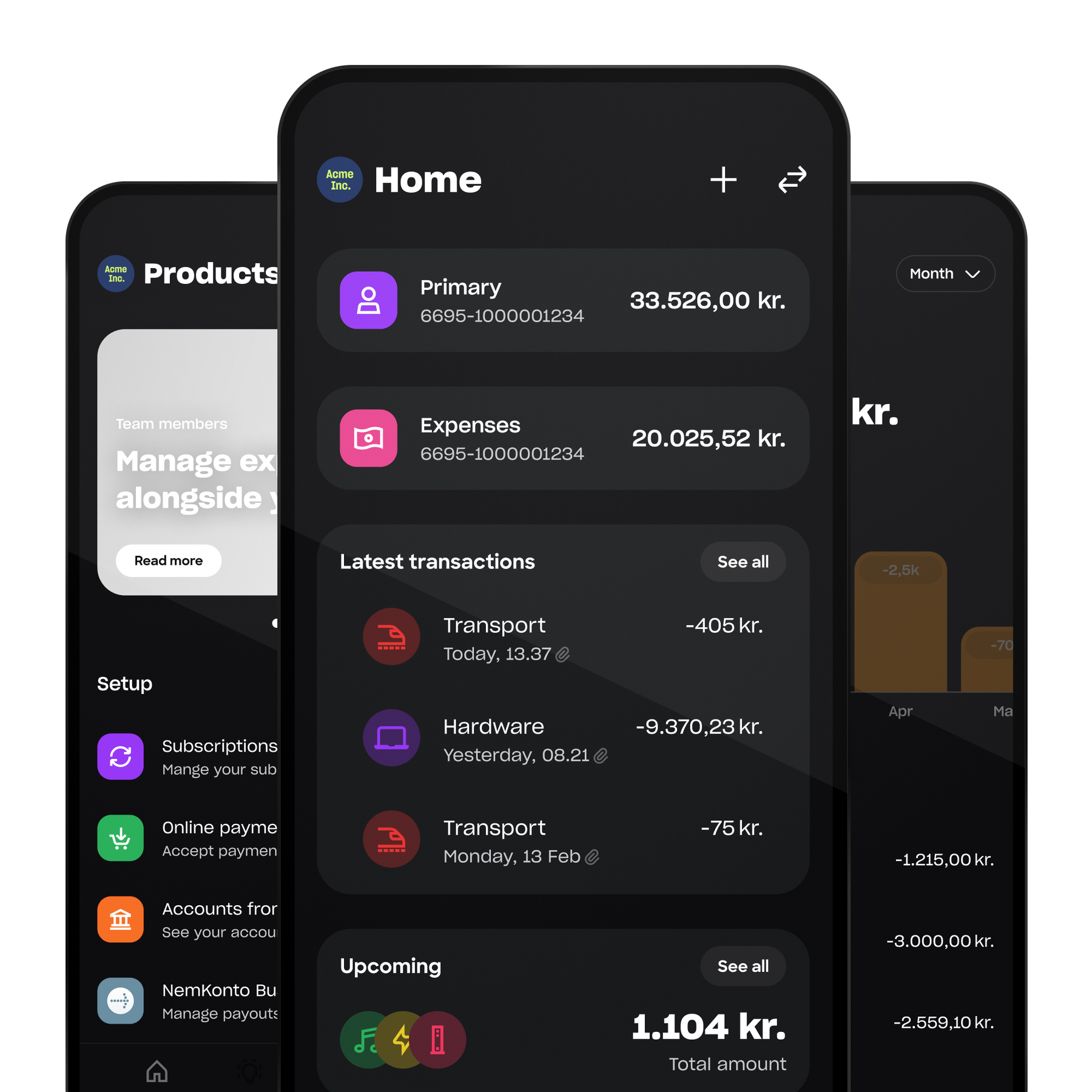

I needed an account for my business, and Lunar was a tremendous help. There were absolutely no hidden fees, poor service, or anything of the sort. The banking app is incredibly user-friendly and easy to navigate. I'm thrilled that I chose Lunar for my business.

Alex, Trustpilot, August 28 2023**

Great support! I applied for a business account with Lunar Bank and had the pleasure of talking to Nikolina, a friendly and highly skilled employee who guided us through the entire process. I definitely recommend Lunar.

Mads, Trustpilot, August 27 2023**

Quick and easy.

Layla, Trustpilot, 16 August 2023**